District of West Vancouver council is formally asking the province to scrap the additional school tax on homes assessed above $3 million and to curtail the speculation and vacancy tax.

The school tax, which adds an additional 0.2 per cent to the regular school tax for the residential portion assessed between $3 million and $4 million and a 0.4 per cent tax rate on the portion assessed above $4 million, comes into effect this year and is expected to disproportionately hit West Vancouver.

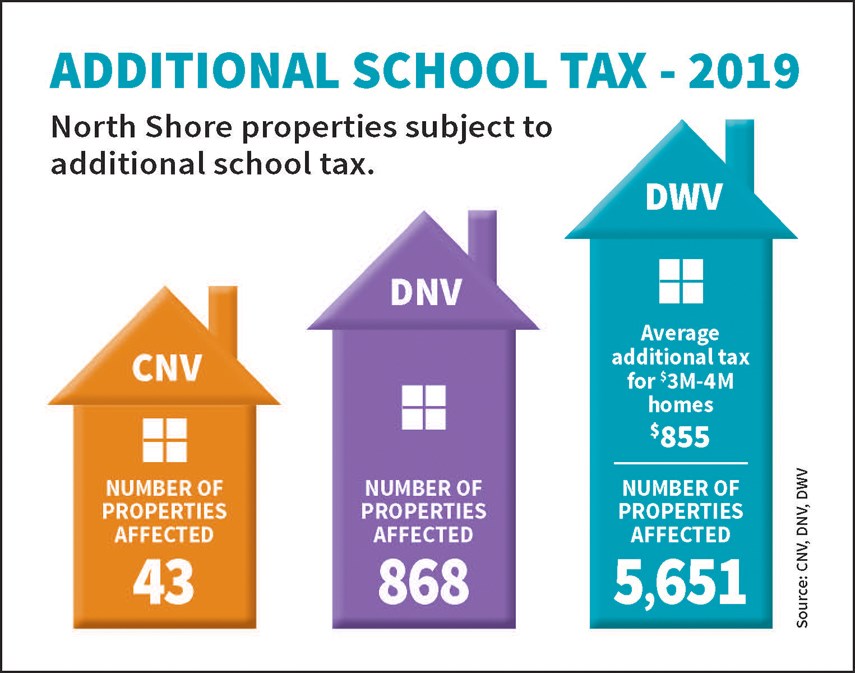

There are an estimated 5,651 homeowners in West Vancouver who will be subject to the tax, based on the latest property assessments – just over a third of the municipality.

Someone whose home is assessed at $3.5 million, for example, would see an $855 increase in their school taxes compared to last year. The district calculates there are 2,616 properties in the $3- to $4-million range. For the 3,034 properties assessed above $4 million, the tax increase jumps by about $4,000 for every $1 million in assessed value. For the 30 homeowners whose properties are assessed at more than $15 million, the average school tax increase will be $63,447.

Of the 17,443 properties across B.C. that will be subject to the tax, just over 17 per cent are within West Vancouver. The District of North Vancouver, by comparison, has 868 homes that will be subject to the tax. The City of North Vancouver has just 43.

The district estimates West Vancouverites will collectively pay an additional $29.8 million in taxes this year.

Coun. Sharon Thompson won unanimous support for a motion to West Vancouver council Monday night calling on the province to scrap the tax entirely. In her arguments, Thompson noted the school tax encroaches on the municipality’s tax base while council is struggling to keep local tax increases down, that the tax is inequitable and that it is “just wrong.”

“This is an asset tax. It’s not based on people’s ability to pay and because of that, I hear countless stories of seniors, retirees and other people who have fixed incomes who purchased their homes decades ago and they’re threatened,” Thompson said. “They’re burdened by this tax. It’s going to impact them and not in a good way. These are vulnerable populations that you want to help live out their lives comfortably and securely as they had planned for.”

Coun. Bill Soprovich was even more blunt.

“Absolutely outrageous,” he said. “I just can’t believe we are put to this degree of a money grab.”

Coun. Craig Cameron said he accepts progressive taxation but added the school tax was too punitive for West Vancouver, which he posited will be putting up roughly a quarter of all the money raised by the school tax in B.C. with less than one per cent of the population.

“There’s obviously a limit and this goes so far beyond the limit, that’s it’s not really arguable,” he said.

Coun. Marcus Wong raised the spectre of the provincial NDP lowering the threshold from $3 million as property prices are falling, especially at the higher end.

Coun. Nora Gambioli voted with the majority on council but not before warning about the unintended consequences. Gambioli predicted West Vancouverites would come across as “uber-rich crybabies” engendering little sympathy in Victoria when council’s efforts could be better spent persuading Finance Minister Carole James to make sure much of the money comes back to West Vancouver in the form of affordable housing funding, which she’d made some progress on the last time the two met.

“Two per cent of the properties in B.C. are going to be affected by this. Two per cent. That means the other 98 per cent of property owners in the province have no sympathy for us,” she said. “Perhaps a backlash could occur with that offer. Perhaps, politically, that offer is going to be taken off the table.

Mayor Mary-Ann Booth said she too had reservations about the motion, noting that $3 million sounds like riches to the generation of people who are struggling to pay their rent. But she voted in favour largely because of the inequitable nature of the tax increase, and how it would hamper the district in finding the funds needed for its own budget.

“We have a housing crisis but I … will follow the wishes of council. I will write the letter to the ministry. I will follow up with the meeting with the minister,” she said.

In a separate motion, Thompson persuaded the majority on council to also write to the province requesting that the speculation and vacancy tax be amended to exclude Canadian citizens and that any money collected from West Vancouver homeowners captured by the tax be directed back into the district to be used for affordable housing initiatives.

“I’m concerned that it doesn’t actually accomplish what it sets to and there are lot of people who are hit unduly by this tax. And I believe it’s our responsibility to relay effectively to senior governments about what we need in our community to sustain it,” she said.