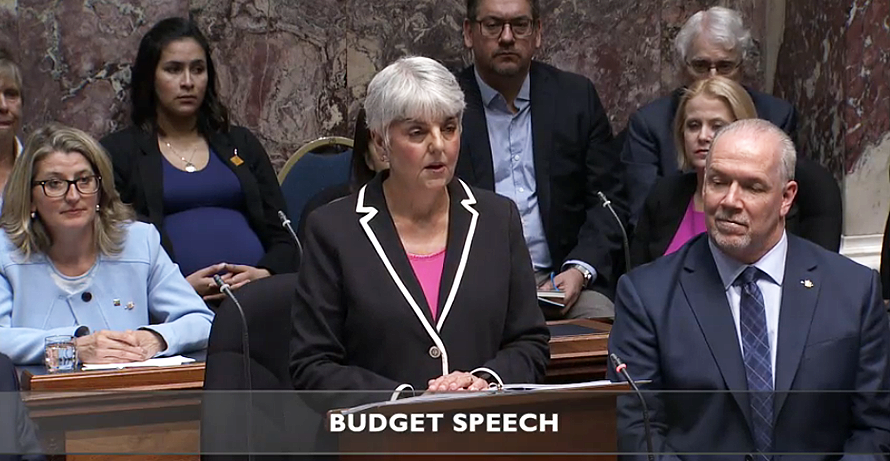

Changes to the proposed B.C. speculation tax, announced by finance minister Carole James yesterday following a backlash from owners, have been broadly welcomed – but do not go far enough, according to industry groups.

Although the geographical boundaries of the tax have been tweaked, the municipalities of Kelowna and West Kelowna are still included. This could be a huge problem for these tourism-driven economies, as it may result in a virtual halt in new housing, according to a statement issued by the Canadian Home Builders’ Association of BC.

CEO Neil Moody stated, “We see this tax as still hitting tourism-driven areas, even if the tax is now lowered [for B.C. residents and other Canadians]. In recent weeks, CHBA BC has heard countless stories from members who have told of contracts now being cancelled for new housing in West Kelowna and Kelowna, because of the tax. These new projects would have created jobs for many in the Okanagan, beyond just the home building companies – glaziers, framers, product suppliers, manufacturers, and more. It does not make sense to focus on one area in the Interior alone. This creates a competitive disadvantage and an immediate unlevel playing field between those on the right and wrong side of the boundary.”

Moody’s statement said that he hopes the CHBA-BC and the B.C. government can work together to “clarify remaining concerns” about the tax.

This hope was echoed by the British Columbia Real Estate Association, which welcomed the changes but said it looks forward to “more answers as the speculation tax takes shape.” The BCREA said it was looking for opportunities to “minimize its negative impact for homeowners who pay income tax in Canada.”

The association raised concerns over the potential economic impact on communities inside the tax’s geographic boundaries, stating, “Communities could face economic problems, due to fewer visitors [and] less consumer spending.”

The BCREA also said that it was unfair for owners of second homes within the City of Vancouver, where there is already an Empty Homes Tax in place. “Homeowners in the City of Vancouver could potentially be charged twice for leaving their homes vacant: once by the city and once by the province.”

It added, “Also, development properties are often bought years before they are developed, and the proposed tax would add costs that would be passed on to consumers, regardless of where they pay tax.”

The BCREA suggested that home owners could be incentivized to rent out their homes, rather than taxed for not doing so.

The association showed some optimism that there could be some further changes made to the tax by concluding, “BCREA urges the BC Government to undertake a formal, public consultation on the proposed speculation tax, to ensure the best input and insights are available, and to assure those affected that this measure is being carefully considered from all angles.”

Unless a second round of changes is issued before then, more details will come to light when the enabling legislation on the speculation tax is tabled in the fall sitting of the legislature, scheduled for October 1.