Almost every owner of a nondescript 1950s bungalow on the North Shore is now a millionaire.

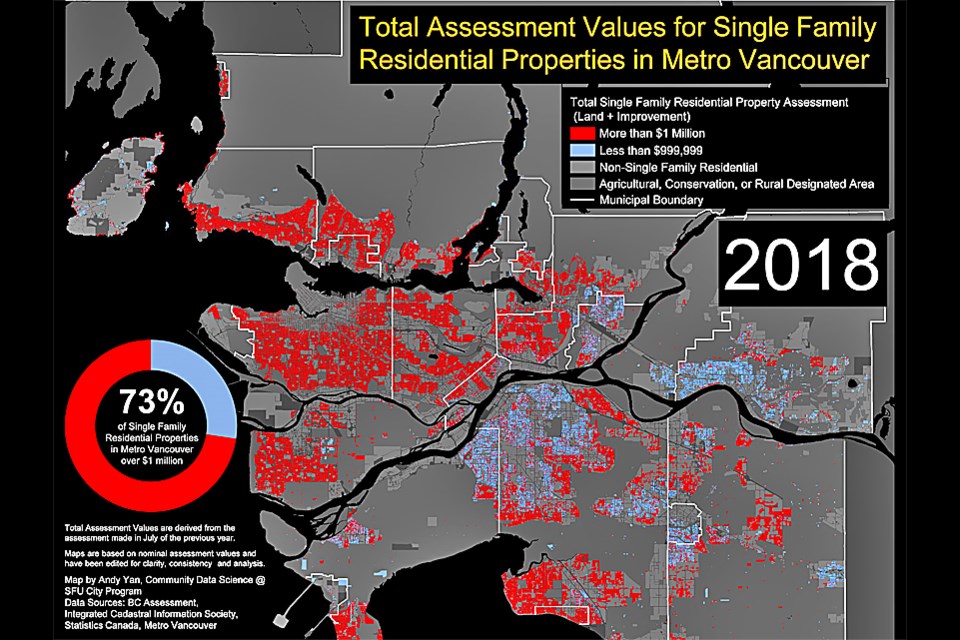

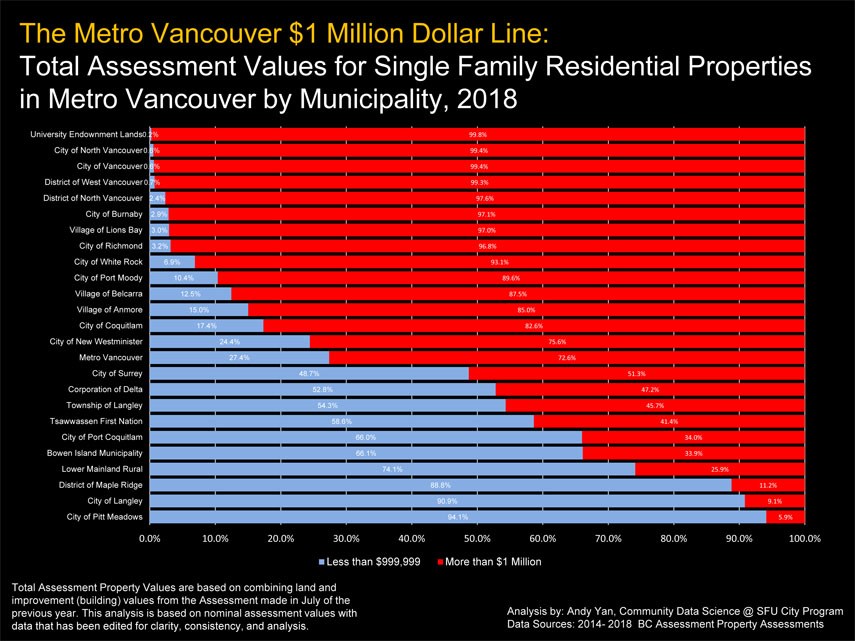

In fact, the “million dollar line” that used to divide West Vancouver and most of North Vancouver in the past has all but disappeared, with 98 per cent of single-family homes on the North Shore worth more than $1 million.

That’s among the highest percentage of million-dollar homes in the region, ranging from 97.4 per cent of all detached homes in the District of North Vancouver to 99.4 per cent in the City of North Vancouver – the same percentage in the City of Vancouver, and just under the percentage for the University Endowment Lands.

The information comes from Andy Yan, director of Simon Fraser University’s City Program, who has been mapping the “million dollar line” in Metro Vancouver for the past five years.

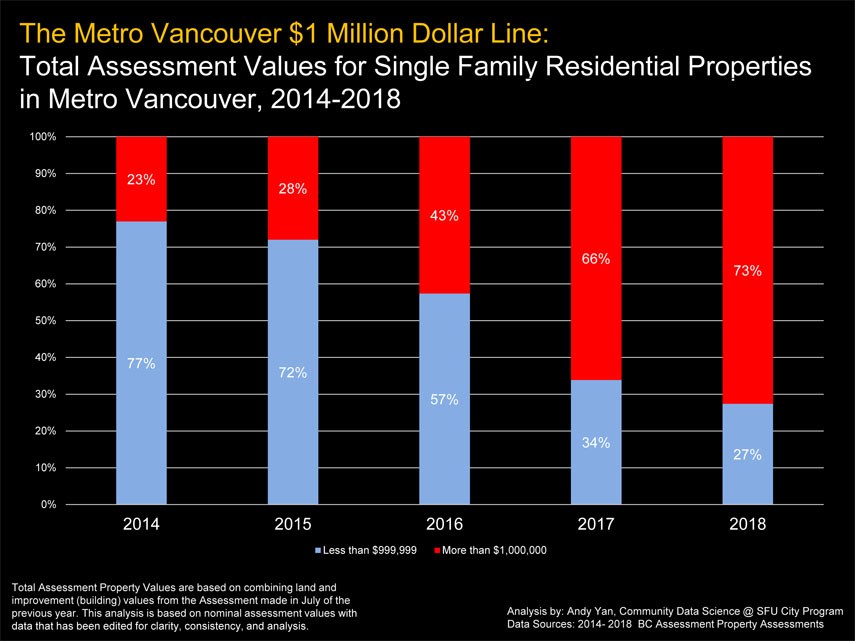

That 73 per cent of single-family homes in the region are now worth more than $1 million – and that the “million dollar line” has now been pushed out into the Fraser Valley and other surrounding suburbs – is an indication of how fast real estate values have risen, said Yan.

As late as 2014, million-dollar homes were largely concentrated in affluent neighbourhoods of West Vancouver and the west side of Vancouver, said Yan.

But that’s changed dramatically. Large areas of North Vancouver were pushed over the million-dollar line starting in 2016.

“A million-dollar home used to be the upper crust of residential real estate. Now it’s become the whole loaf,” said Yan. “That leads into some profound challenges.”

“Is $2 million the new $1 million line?” he asked. ”How do you create family friendly neighbourhoods when a single-family detached home may not be attainable on local incomes? That’s really going to be the challenge for the community.”

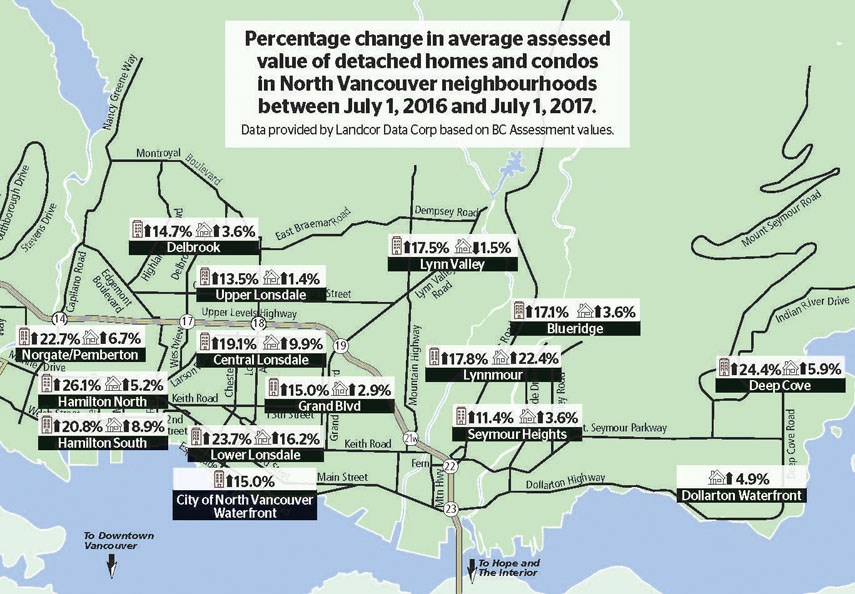

Those squeezed out of the market for single-family homes – or downsizing from them – are now putting pressure on the condo market, which has seen some of the largest jumps in assessed values this year.

Source: graphic Birgit Brunner, North Shore News

Condos in view areas like Lower Lonsdale, Deep Cove, the West Vancouver waterfront and the Hamilton neighbourhood near Pemberton Heights all increased in value between 20 and 37 per cent this year, according to Landcor Data Corp., which analyses BC Assessment data by neighbourhood.

Condos in many areas of the North Shore – from Lynnmour to Caulfeild – saw values rise between 10 and 25 per cent.

Hikes to the assessments of single-family homes were largely confined to single-digit increases.

Again, areas like Lonsdale and Hamilton saw some of the bigger increases, although detached homes in Lynnmour – once considered one of the last affordable areas of the North Shore – went from an average value of $1.2 million to $1.5 million last year.

Last week, the province raised the threshold at which property owners stand to lose part of the homeowners grant from $1.6 million to $1.65 million.

The grant provides $570 towards property taxes for owners who qualify for the basic grant and more for seniors.

On the North Shore, about 33,500 homeowners – about half the total number – will qualify for the grant this year, according to Landcor data.

That’s about the same as received the grant last year, after the previous Liberal government hiked the threshold from $1.2 million to $1.6 million.

Owners of both condos and single-family homes in the District of North Vancouver and condo owners in the City of North Vancouver made up the bulk of grant recipients.

A record number of property owners in the province – more than 4,458 – also had their assessments specially adjusted this year, to account for skyrocketing property values.

Under section 19.8 of the Assessment Act, help is granted to a very small number of homeowners in cases where land values have soared because the property could be put to a substantially different “higher and better” use but the house is still being occupied by the owners as a regular home and has been for at least 10 years.

“It speaks to the (situation of) the longtime homeowner whose income just can’t keep up,” said Jeff Tisdale, chief executive officer for Landcor, whose analysts crunched numbers based on the BC Assessment information.

A total of 207 homeowners on the North Shore qualified for that help this year – just slightly more than last year. Over half of those were homeowners in the City of North Vancouver.