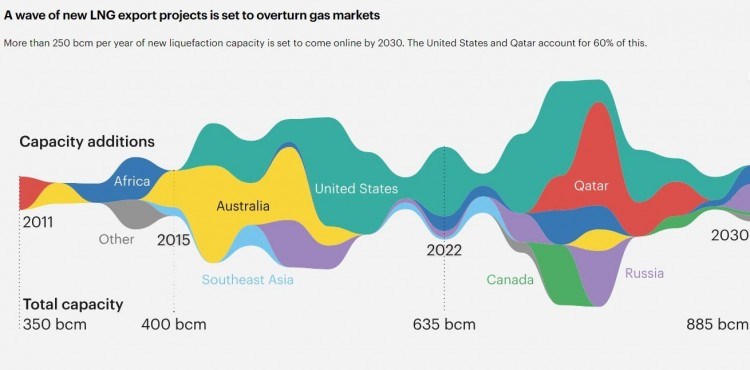

An abundance of natural gas will flood onto the global market in the form of liquefied natural gas (LNG), starting in 2025, with Canada being among the countries contributing to a sudden “surge,” and with Russia being the biggest loser, according to the International Energy Agency (IEA).

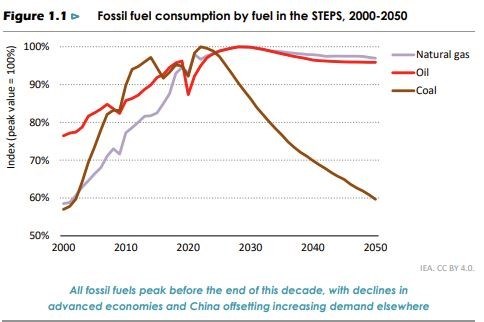

In its newly published 2023 World Energy Outlook, the IEA predicts the demand for all three fossil fuels – coal, oil and natural gas – will peak in 2030, and then start to decline, with coal experiencing the sharpest declines, based on current stated policy scenarios (STEPS).

“The share of coal, oil and natural gas in global energy supply – stuck for decades around 80 per cent – starts to edge downwards and reaches 73 per cent in the STEPS by 2030,” the outlook forecasts.

A sharp decline in coal demand will come from countries switching from coal power to renewables and other lower carbon fuels, including natural gas. But even natural gas’s days are numbered, the IEA predicts.

“The ‘Golden Age of Gas’, a term coined by the IEA in 2011, is nearing an end,” the outlook declares. “Global natural gas use has increased by an annual average of almost 2 per cent since 2011, but growth slows in the STEPS to less than 0.4% per year from now until 2030.”

The outlook shows Canada making an entrance on the world stage as sizeable LNG exporter in 2025. But once the first big bolus of Canadian LNG hits the world market – mostly from the LNG Canada project in Kitimat – future incremental increases of LNG exports from Canada are projected to be relatively small, compared to the U.S. and Qatar, which are expected to account for 60 per cent of the new volumes of LNG.

“Starting in 2025, an unprecedented surge in new LNG projects is set to tip the balance of markets and concerns about natural gas supply,” the outlook states.

“Projects that have started construction or taken final investment decision are set to add 250 billion cubic metres per year of liquefaction capacity by 2030, equal to almost half of today’s global LNG supply.”

Additions of LNG from countries like the U.S., Qatar, Canada and Australia may come at Russia’s expense.

“This additional LNG arrives at an uncertain moment for natural gas demand and creates major difficulties for Russia’s diversification strategy towards Asia,” the outlook predicts. “The strong increase in LNG production capacity eases prices and gas supply concerns, but comes to market at a time when global gas demand growth has slowed considerably since its ‘golden age’ of the 2010s.

“The glut of LNG means there are very limited opportunities for Russia to secure additional markets. Russia’s share of internationally traded gas, which stood at 30 per cent in 2021, is halved by 2030 in the STEPS.”

Russia is a major oil and natural gas producer. But after it invaded Ukraine, oil and natural gas markets were upended, triggering a major energy crisis, which had in fact been brewing in Europe before the war in Ukraine.

Russia lost a massive European market for its natural gas overnight. The energy crisis it exacerbated has accelerated the move to renewables, conservation and various lower carbon forms of energy and transportation.

“A legacy of the global energy crisis may be to usher in the beginning of the end of the fossil fuel era: the momentum behind clean energy transitions is now sufficient for global demand for coal, oil and natural gas to all reach a high point before 2030 in the STEPS,” the outlook states.

“In advanced economies, the rebound in natural gas demand seen in 2021 did not last long, and demand in 2022 was below pre-pandemic levels. This faltering in demand reflects a shift to renewables in electricity generation, the rise of heat pumps, and Europe’s accelerated move away from gas following the Russian Federation … invasion of Ukraine.”

Just how much the global demand for coal, oil and natural gas will fall depends a great deal on China, which may no longer be the economic juggernaut it once was. If China’s growth averages under four per cent per year between now and 2030, the IEA projects that China’s total energy demand will start peaking the middle of this decade.

To underscore just how important China is, in terms of global energy consumption, the IEA notes that a single one per cent decline in China’s annual economic growth would reduce Chinese LNG imports by 20 per cent.

“If China’s near-term growth were to slow by another percentage point, this would reduce 2030 coal demand by an amount almost equal to the volume currently consumed by the whole of Europe,” the IEA notes. “Oil import volumes would decline by 5 per cent and LNG imports by more than 20 per cent, with major implications for global balances.”

The David Suzuki Foundation has seized on the IEA’s latest forecast to suggest no more LNG projects should be built in B.C.

“The IEA's authoritative assessment proves, again, that LNG is the wrong choice at the wrong time," John Young, the foundation’s B.C. Energy Transition Strategist, said in a press release.

"Any new LNG projects in B.C. brought online or beginning exports after 2025 would likely end up as stranded assets. No new LNG supply is needed in a world rapidly shifting to renewable energy as the climate crisis intensifies.

“Global demand for gas is slowing down. B.C. missed the golden era of gas and projects that begin construction now are likely to become stranded assets."

But despite its projections for fossil fuels peaking, the IEA outlook warns against halting all investment in fossil fuels.

“Continued investment in fossil fuels is essential in all of our scenarios,” the outlook says. “It is needed to meet increases in demand over the period to 2030 in the STEPS and to avoid a precipitous decline in supply that would far outstrip even the rapid declines in demand seen in the NZE (net zero) Scenario.”

The outlook also warns against over-investment, however, depending on how rigorous governments are in meeting climate policy targets.

“Investment in oil and gas today is significantly higher than the amounts needed in the APS (announced pledges scenario) and almost double what is needed in the NZE Scenario. This creates the clear risk of locking in fossil fuel use and putting the 1.5 °C goal out of reach.

“Nonetheless, simply cutting spending on oil and gas will not get the world on track for the NZE Scenario: the key is to scale up investment in all aspects of a clean energy system to meet rising demand for energy services in a sustainable way.

“Both overinvestment and underinvestment in fossil fuels carry risks for secure and affordable energy transitions.”