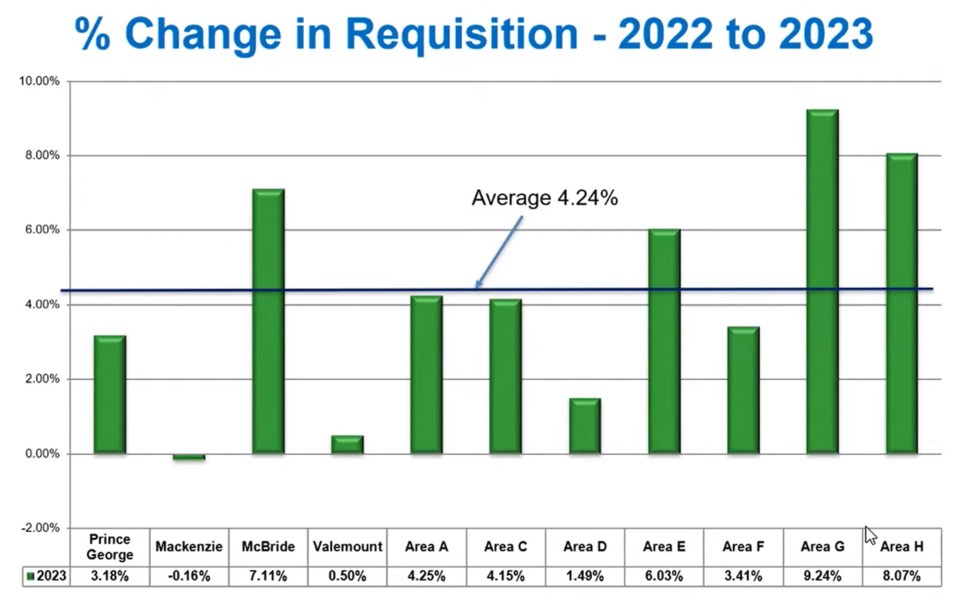

The Regional District of Fraser-Fort George is predicting an overall 4.24 per cent property tax increase for 2023, following budget deliberations on Wednesday afternoon.

The district’s tax requisition was expected to increase by roughly $873,000, up to $21.46 million, district general manager of financial services Chris Calder said. Of the total regional district tax requisition, $8.54 million will come from City of Prince George property owners, up from nearly $8.28 million in 2022.

“The majority of services are requesting small increases this year,” Calder said. “That does provide a 4.24 per cent overall change to the requisition.”

The increase will be largest for the regional district in the past five years. Between 2018 and 2022, the district’s tax requisition grew an average of 2.098 per cent, ranging from 1.33 per cent to 2.67 per cent per year.

However, the municipalities and rural electoral areas that make up the regional district will see differing tax increases, depending on which services the regional district provides in their area, he said. The tax amounts on individual properties will also vary, depending on their property value assessment by BC Assessment.

City of Prince George property owners will see an average 3.18 per cent increase on the regional district portion of their property tax bill. The City of Prince George collects property taxes on behalf of the regional district, Fraser-Fort George Regional Hospital District Board, provincial school tax, Municipal Finance Authority, B.C. Assessment and other agencies.

In 2022, the regional district taxes on an average Prince George house - valued at $410,891 - were $184, according to BC Statistics data. A 3.18 per cent increase amounts to a roughly $5.85 increase. On Feb. 1, Prince George city council approved a 7.58 per cent tax increase, a roughly $175 increase for the average house.

Last year the property taxes on an average Prince George house totalled $3,666 - $2,366 city taxes, $184 regional district taxes, $311 for the hospital board, $791 in school taxes and $14 in taxes for other agencies.

The average property tax increase in the other areas of the regional district were projected to be:

Electoral Area A (Salmon River-Lakes): 4.25 per cent

Electoral Area C (Chilako River-Nechako): 4.15 per cent

Electoral Area D (Tabor Lake-Stone Creek): 1.49 per cent

Electoral Area E (Woodpecker-Hixon): 6.03 per cent

Electoral Area F (Willow River-Upper Fraser Valley): 3.41 per cent

Electoral Area G (Crooked River-Parsnip): 9.24 per cent

Electoral Area H (Robson Valley-Canoe): 8.07 per cent

Mackenzie: -0.16 per cent

McBride: 7.11 per cent

Valemount: 0.5 per cent

Tax revenue is projected to only make up 38.9 per cent of the regional district’s nearly $55.24 million budget for 2023, Calder said.

Funding from reserves (23 per cent), fees and charges (16.7 per cent), surplus funds (10.2 per cent) and assorted other revenue sources (11.3 per cent) make up the majority of the district’s planned 2023 budget, he said.

Overall budgeted expenses were down by almost $2.6 million, Calder said, largely due “to a reduction of our capital program.”

While the regional district is waiting to finalize some budget numbers, the changes were not expected to be significant, Calder added.